Dear All

The question often arises: Why would a property seller agree to an AffordAssist Deferred Deposit Property Sale?

It’s a fair question — and one that makes sense, because AffordAssist represents a new way to think about how we buy and sell property. Below, we share our perspective, real-world experience, and how this approach can lead to personal financial gain.

Perspective

Selling a property isn’t always just about the numbers. It can also be emotional — filled with memories, milestones, and meaning.

Beyond the financials lies something deeper: Emotional Value.

Property sellers and developers often make decisions based on more than price alone. Sometimes it’s about the buyer’s attitude, appreciation, or sense of purpose. For many, it’s also about cooperation — a willingness to help the next owner and contribute to our shared social fabric. Click to read about this perspective

Experience — 8 Years On

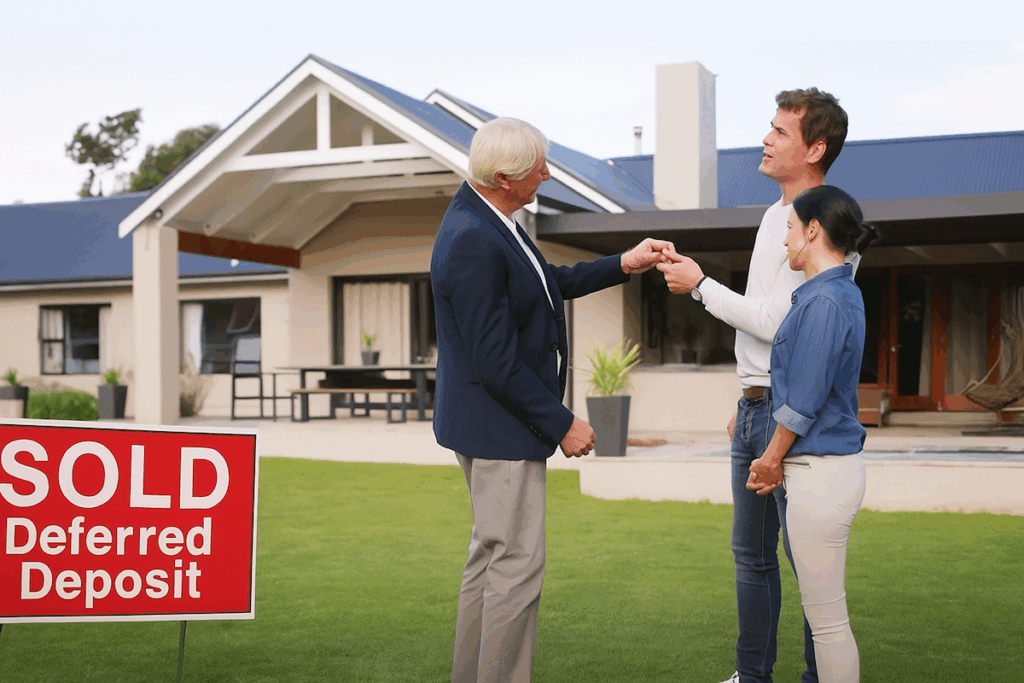

AffordAssist’s interest-free deferred deposit solution taps into the equity of willing property sellers to create a combined home loan and deposit pathway.

Over the past eight years, we’ve seen that Australians genuinely care about the next generation. Many sellers not only have the equity — but also the reason — to consider this kind of offer.

With respectful communication and the right education, we continue to see strong openness to AffordAssist proposals.

In our experience, around ‘1-in-?’ property offers are accepted through AffordAssist — and the variable is effort.

Working with an approved Buyer’s Agent provides buyers with the best possible chance of success. Click to read more Australian property sellers DO CARE about the Next Generation

Personal and Family’s Financial Gain

You have your AffordAssist Approved PDF in hand. Now, ask the question:

“I offer to buy this property with the AffordAssist Deferred Deposit Solution.”

By taking this step, you are positioning yourself as a confident, prepared, and qualified buyer.

In most cases, this approach can secure a yes from the seller within three months.

Is it worth the effort? Let’s look at a real-life example:

- Reduce the loan amount by 10% on an $800,000 purchase = $80,000

- Typical repayments to a lender (≈3×) = $240,000

- With AffordAssist – interest-free = $80,000

✅ You save $160,000

It is not for the agent to say no — they will put your offer forward.

If a seller says no, simply present your offer to the next property, and continue to ASK until you get a yes. After all, your approval is ready — and a “yes” directly impacts you and your family’s future.

Governance + Systems:

In a way, AffordAssist has started a new industry phrase… Deferred Deposit Property Sale.

For the mortgage broker it is business as usual.

For the agent it is also business as usual.

AffordAssist manages the deferred deposit process.

For Your Consideration:

Is achieving a faster, safer purchase worth the effort?

For most buyers, the answer is a resounding yes — because it transforms the sameness equation into a structured, achievable path to home ownership.

AffordAssist Helping Buyers Break the Sameness Equation

This is how housing affordability becomes a shared ecosystem — a community-centric solution — rather than the sameness equation.

It signals a shift — from affordability being a personal struggle to becoming a shared, structured opportunity for buyers, sellers, lenders, and government alike.

Regards

AA

B2B – AffordAssist facilitates and oversees the governance process. Are you a mortgage broker, lender, developer, real estate agent, affordable housing advocate, or housing minister? We welcome your collaboration. Join us in our mission to expand access to home ownership. Together, we can make a lasting impact.