Dear All,

For thousands of Australians, the biggest barrier to home ownership isn’t income—it’s the deposit gap. Traditional solutions—the “sameness equation”—including government cash interventions, shared-equity schemes, guarantor loans, high-LVR mortgages, or SMSF, often come with hidden costs: interest, reduced ownership control, family risk, or lower realised equity.

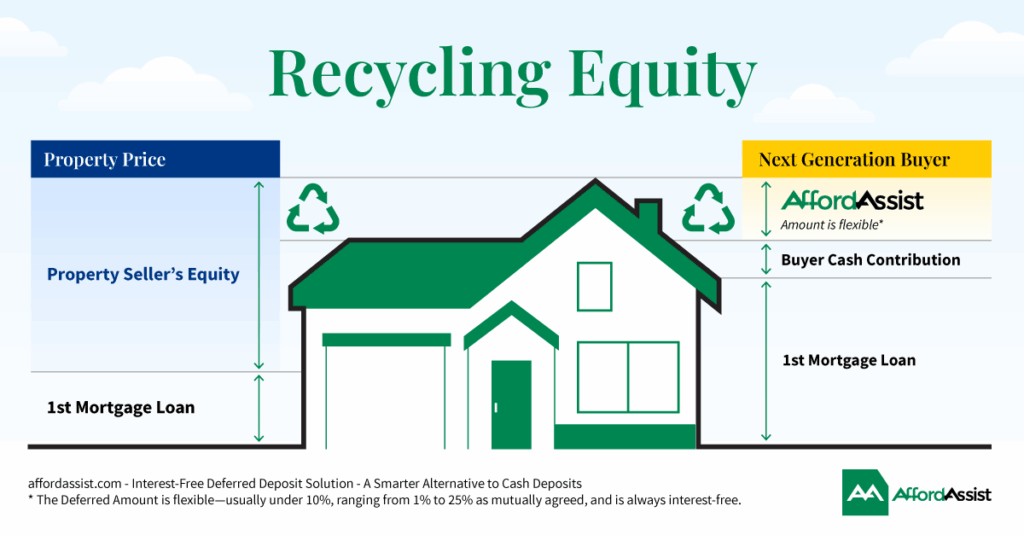

Enter AffordAssist. Our interest-free deferred deposit solution breaks the sameness equation, helping buyers bridge the gap—borrow smarter, build equity sooner, and buy sooner. It does this by recycling equity to support the next generation of homeowners.

Industry experts estimate Australia’s residential property market at around $11.6 trillion. Even a modest 10% slice of latent equity represents more than $1 trillion in potential buying power— recycled, could meaningfully help the next generation enter the market.

The Problem with Conventional Equity Loan Structures — the “Sameness Equation”

Government Cash Interventions

Reliance on government cash to solve deposit barriers can introduce other economic pressures and may even create new crises later. It’s important to distinguish social housing from affordable housing: mixing these objectives risks stretching public funds too thin and failing to address the underlying affordability crisis.

Shared-Equity Schemes

You may avoid interest, but a government or institutional partner takes a slice of your property. Ownership and future upside are shared.

Family Guarantees

Parents secure part of your loan. It works—until relationships strain or other financial implications arise.

Unconventional Loan Products

High-LVR loans (e.g., 80% LVR + 20% second mortgage, 95% LVR, or 105% LVR) solve the deposit problem today but often create new costs tomorrow. Interest takes priority in repayments, slowing principal reduction and increasing total repayment over time.

SMSF Workarounds

Some buyers look to their Self-Managed Super Fund for a deposit solution—either by trying to lend from the SMSF, restructure contributions, or use complex borrowing arrangements. But using SMSF retirement funds to bridge a deposit gap can introduce compliance risk, reduce long-term super balances, or create unintended tax consequences.

The real question is: How easily can a buyer get out? How cleanly can they exit, refinance, restructure, manage risks, and understand their net equity position after five years?

Without asking these questions — without applying this lens — some solutions can unintentionally compromise the buyer, cause more harm than good, or even create new crises later.

AffordAssist Interest-Free Deferred Deposit Solution — A Smarter Alternative to Cash Deposits

Purchase a property—whether off-the-plan, newly built, established, or house-and-land—from a willing seller using a partial deposit upfront, and defer the remaining deposit interest-free. The deferred amount is typically for 60 months, up to 120 months (or longer by mutual agreement), while you retain 100% ownership from day one.

It signals a shift — from affordability being a personal struggle to becoming a shared, structured opportunity for buyers, sellers, lenders, and government alike.

When applying for your home loan, ask your mortgage broker for two approval options:

- A standard home loan

- A home loan paired with an AffordAssist Deposit Certificate

Evaluating both options side by side shows the difference in repayments and how much less interest can be paid when pairing with AffordAssist.

Example: Why This Matters — and Is It Worth the Effort for Buyers?

- Put an end to tirelessly saving for a larger deposit

- Enter the property market sooner—without extra loan debt or pressure on family, or relying on mum and dad for the full amount

- Reduce the loan amount by 10% on an $800,000 purchase = $80,000

- Typical repayments to a lender (≈3×) = $240,000

- With AffordAssist — interest-free = $80,000

→ You save approximately $160,000

Why This Model Is Smarter Equity

- Aligned With Community Equity & Next-Generation Demand

For generations, Australian property sellers have benefited from equity gains supported by a stable economy. Recycling some of this equity through the AffordAssist interest-free deferred deposit solution has been helping the next generation access home ownership since 2017, demonstrating an eight-year track record of practical, community-driven affordability support. This approach channels existing equity in a community-centric way — with no interest, no pressure, and a simple ask of willing sellers — enabling equity to flow directly to the next generation.

- Scalable — No Funding Required

Because AffordAssist doesn’t rely on a capital pool, it scales instantly. Pre-approvals and broker integration make the process fast, simple, and accessible.

- Risk-Managed for All Stakeholders

A clear governance process protects the interests of lenders, LMI providers, property sellers, and buyers. The arrangement is secured by a caveat—not a second mortgage—with built-in valuation buffers. Due process is critical to successful settlements and payment of the deposit balance:

- Loan Settlement: The AffordAssist Deposit Certificate confirms adherence to the governance process and forms part of the verified funds to settle the home loan.

- Property Settlement: The Deferred Deposit Agreement (DDA) manages the balance of the deposit payments and provides structured protection for all parties involved.

Lenders gain additional equity protection; buyers gain peace of mind.

The Bigger Picture

Home ownership need not remain in crisis. It can also be viewed through a next-generation lens—where today’s owners act as custodians, recycling equity to help the next generation into home ownership.

AffordAssist unlocks pent-up demand without inflating property prices—supporting individual buyers, strengthening the social fabric, and reducing government cash intervention, while contributing to a healthier market.

Ready to Explore AffordAssist?

If you’re a buyer tired of saving endlessly while facing the possibility of renting your future, a broker seeking next-gen pathways for clients, or an investor interested in ethical property enablement—let’s connect.

Next-generation home ownership shouldn’t be trapped in the sameness equation—forced to compromise or risk solutions that do more harm than good. With AffordAssist, it doesn’t have to be.

Regards

AA

B2B – AffordAssist facilitates and oversees the governance process. Are you a mortgage broker, lender, developer, real estate agent, affordable housing advocate, or housing minister? We welcome your collaboration. Join us in our mission to expand access to home ownership. Together, we can make a lasting impact.

#RecyclingEquity #HomeOwnership #PropertyInnovation #HousingSolutions #FirstHomeBuyers #SmartFinance #AffordableHousing