Why Queue for a Rental When You Can Fast-Track Home Ownership?

Your Rental Bond Could Be Enough

Dear All

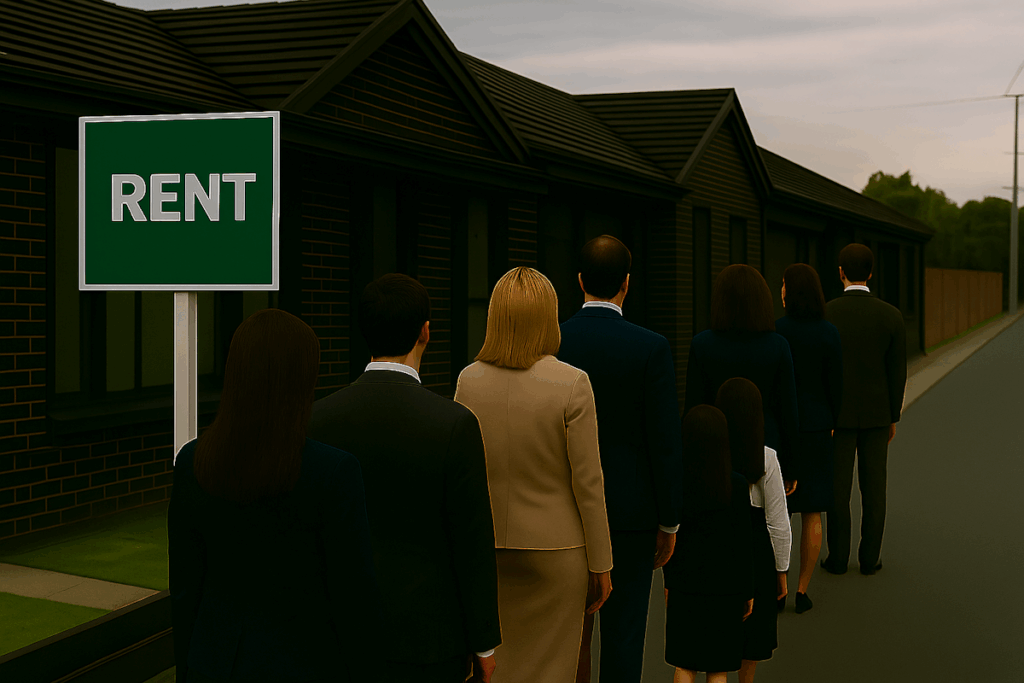

Across Australia, rental queues are growing longer, weekly rents are climbing higher, and competition for homes has reached record levels. Yet, beneath this frustration lies a surprising truth: many tenants are already paying the equivalent of a mortgage — just not for their own home.

Rent and Mortgage: Closer Than You Think

In many suburbs, the gap between rent and mortgage repayments has never been smaller.

For example, if you’re paying $700 per week in rent, that’s roughly equivalent to servicing a mortgage on a home worth around $600,000–$700,000 (depending on the loan structure and rate).

So, if the ongoing cost of a mortgage and rent are so similar, what’s really holding people back from buying?

The deposit.

The Deposit Dilemma

For many home buyers, saving a 2%, 5% or 10% cash deposit is the biggest obstacle — not the loan itself.

They have the income.

They have the borrowing capacity.

But without the full deposit, they remain trapped in the rental cycle.

Traditional advice — work hard, save steadily, and wait your turn — no longer aligns with today’s housing market. Innovation and smarter solutions are available to get a foot on the property ladder.

Introducing a Smarter Alternative: The AffordAssist Interest-Free Deferred Deposit Solution

At AffordAssist, we recognised this barrier and decided to challenge the long-held assumption that you need the entire cash deposit upfront.

Our Interest-Free Deferred Deposit Solution enables qualified buyers to secure their home with as little as 1% upfront, deferring the balance of the deposit interest-free.

This means:

- You can buy sooner instead of waiting years to save the full deposit.

- Your rental payments can be redirected toward your own home, not your landlord’s mortgage.

- You start building equity today, not after another decade of saving.

Your Rental Bond Could Be Enough

Here’s something to consider: your rental bond could help you fast-track your home deposit.

When you move from renting to buying, your rental bond — typically equivalent to four weeks’ rent — is released.

For some buyers, that amount could be enough to cover their initial 1% deposit, while the balance of the deposit is deferred interest-free through AffordAssist.

In other words, what once secured your place in a rental could now secure your place in your own home.

This simple shift in how you view your bond can transform it from a locked-up rental expense into the foundation of your future equity.

Why Keep Renting When You’re Already Paying “Mortgage Money”?

When you think about it, every month you’re already proving you can manage regular housing payments. The only difference is who benefits — your landlord or your future self.

By redirecting those same dollars into home ownership, you take control of your financial future and enter the market sooner, even while property prices continue to rise.

Rethink What a Deposit Could Be

Home ownership isn’t just about leaving the rental market — it’s about stability, freedom, equity, intergenerational wealth, and a sense of belonging.

With innovative solutions like AffordAssist, the traditional concept of a deposit no longer needs to be a barrier or a decade-long waiting game. What once seemed like a fixed upfront cost can now be reimagined and deferred, allowing renters to turn their existing payments — even their rental bond — into the foundation of their future home.

The AffordAssist solution is available now — for many renters, it could be the difference between waiting in a rental queue and stepping into your own front door.

If you’re renting and ready to explore smarter pathways to home ownership, learn more at

Regards

AA

B2B – AffordAssist facilitates and oversees the governance process. Are you a mortgage broker, lender, developer, real estate agent, affordable housing advocate, or housing minister? We welcome your collaboration. Join us in our mission to expand access to home ownership. Together, we can make a lasting impact.