Dear All,

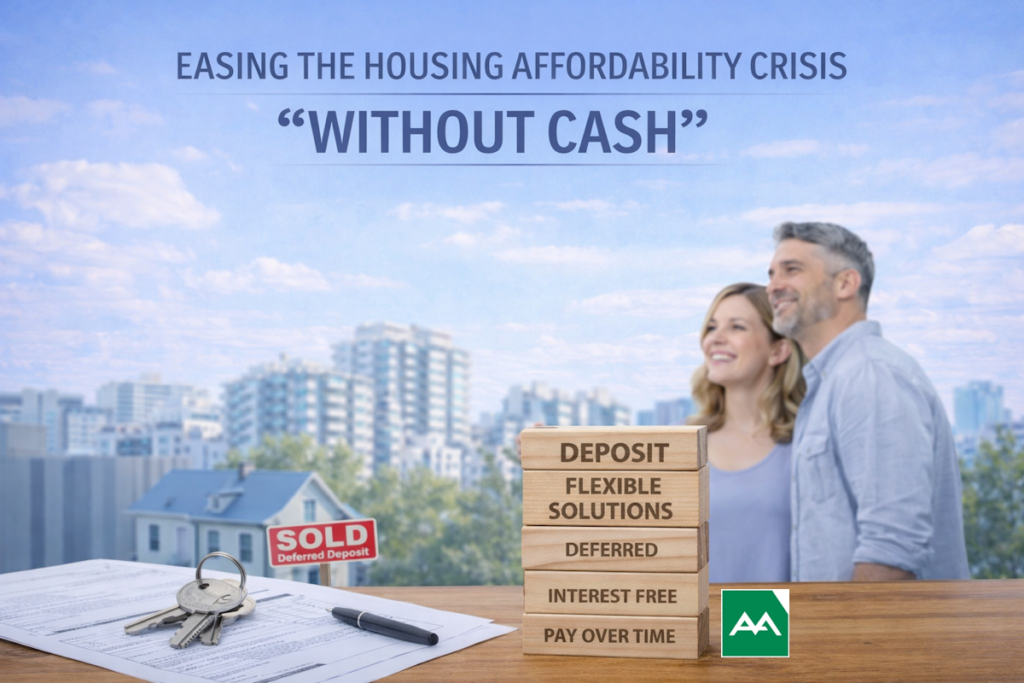

We can ease the housing affordability crisis without cash, using solutions that reflect how the economy continues to change and how people actually live, earn, and pay — not just how housing has traditionally been funded: through the Bank of Mum and Dad, equity, guarantors, second mortgages, personal loans, high-risk structures, or ongoing reliance on government intervention.

Sometimes the most powerful change isn’t more money.

What if we could rethink what a deposit could be — not just reliant on existing cash funds or assets?

AffordAssist’s Interest-Free Deferred Deposit Solution: A Smarter Alternative to Cash Deposits

This is where AffordAssist offers a fundamentally different approach: a mission-driven, innovative home-loan and property-deposit solution that reimagines what a deposit can be, enabling homeownership sooner. It is a first-of-its-kind, flexible deposit-structuring solution designed to ease the housing affordability crisis — without relying on cash.

Instead of requiring buyers to provide the full deposit upfront, AffordAssist allows part of the deposit to be:

- Deferred, rather than paid immediately

- Interest-free, reducing financial pressure

- Paid over time, aligned with real affordability

- Applied to reduce the loan amount, building equity sooner and saving interest over the life of the loan

- Independent of equity, family guarantees, or high-risk or complex structures

AffordAssist recognises that housing affordability improves when access to a home is aligned with a buyer’s ability to pay over time — not just at the start. Its industry-leading governance, designed to protect all stakeholders, can be likened to Credit Risk Transfer (CRT).

The outcome is simple and transformative: lending and property processes remain the same, while AffordAssist replaces the need for additional cash deposits. Buyers can secure a home earlier, through a smarter social enterprise structure. It doesn’t just help buyers; it strengthens our social fabric and economy.

Easing the Crisis

Meaningful progress starts when we recognise that many hands and many solutions are needed to ease the national housing crisis — moving beyond traditional funding methods and embracing solutions fit for today’s needs.

Since 2017, AffordAssist has demonstrated that it is possible to ease the housing affordability crisis without cash — offering a smarter way forward.

Regards

AA

B2B – AffordAssist facilitates and oversees the governance process. Are you a mortgage broker, lender, developer, real estate agent, affordable housing advocate, or housing minister? We welcome your collaboration. Join us in our mission to expand access to home ownership. Together, we can make a lasting impact.

#HousingAffordability #FinancialInnovation #SocialImpact #SystemicChange #EconomicInclusion #HousingCrisis