Dear All,

Housing affordability is often framed as a policy challenge or a market problem.

Despite well-meaning initiatives, homeownership is becoming increasingly difficult — and for many, almost impossible. Over the past decades, at its core, it has become something more: a systemic community issue.

When more Australians can access stable housing earlier, the benefits extend far beyond the individual buyer — into families, generational wealth, workplaces, the social fabric, and the broader national economy.

This is where AffordAssist emerges as a first-of-its-kind solution — rethinking existing structures and integrating seamlessly with established real estate processes, banking systems, conveyancing practices, and lending compliance frameworks — to better serve the community, without increasing risk or debt.

Crucially, the AffordAssist solution does not rely on external funding to provide the deposit. This means it can be scaled efficiently and replicated across markets without requiring capital pools, government grants, or third-party investors.

Social Enterprise Is Not About Charity — It’s About Structure

A social enterprise doesn’t remove commercial discipline.

It redesigns outcomes.

AffordAssist is a community-centric affordability solution because it reshapes how deposits are structured — without distorting lending standards, increasing systemic risk, or relying on ongoing subsidies.

Instead of asking:

“How much can buyers stretch?”

AffordAssist asks:

“How can we reduce the barriers without increasing debt, risk or long-term cost?”

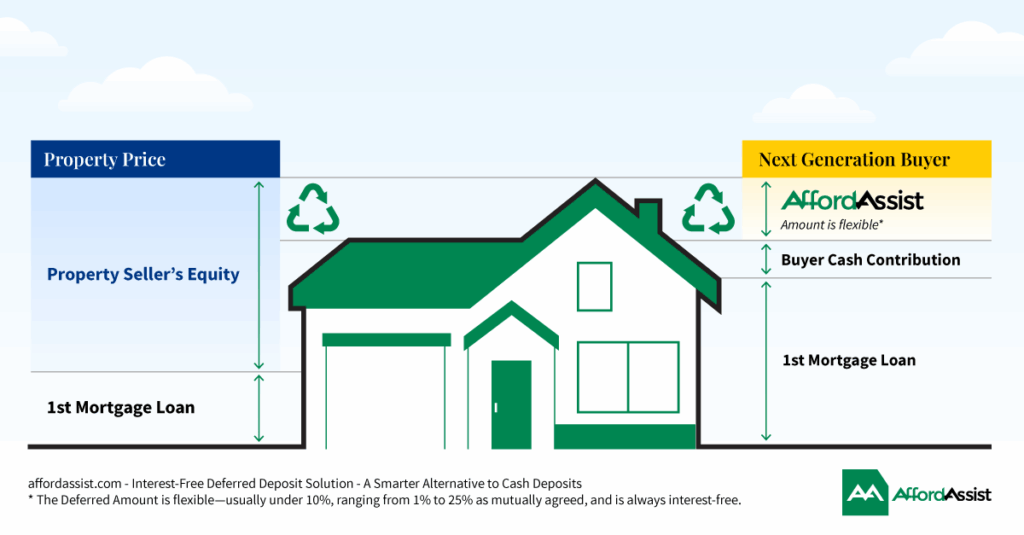

Turning Latent Equity into Support for the Next Generation of Homeowners

One of the largest barriers to homeownership is the up-front cash deposit — not serviceability.

AffordAssist addresses this by:

- Engaging willing property sellers and developers to defer part of the deposit through interest-free payments, shared equity, or a combination of both

- Recycling existing equity to support the next generation of homeowners

- Reducing the immediate cash burden required to enter the market

- Preserving lender protections and established credit-risk frameworks

- Enabling buyers to enter homeownership sooner, reducing long-term interest costs, allowing them to build equity more quickly, and positioning families to achieve greater financial stability and generational wealth over time.

Industry experts estimate Australia’s residential property market at approximately $11.6 trillion. Even a modest 10% share of latent equity represents more than $1 trillion in potential buying power — once considered, could meaningfully assist the next generation into homeownership.

The result isn’t just individual access — it’s efficiency at a national level.

Flow-On Benefits Beyond the Buyer

When affordability barriers are reduced responsibly, the social outcomes multiply:

- Earlier homeownership reduces lifetime housing stress

- Lower loan balances mean less interest paid over time, creating safer loans and reducing the financial strain on buyers

- Social and public housing stock can be freed up sooner for the next family. The outcome is a financially responsible, scalable pathway that builds stability and reduces long-term reliance on government support

- Workforce mobility improves

- Mental wellbeing improves

- Communities stabilise rather than fragment, empowering intergenerational wealth

- Ease pressure on the rental market by increasing housing availability

- Social assimilation improves

- Relief for the “Bank of Mum and Dad” – rethinking expectations and reducing family distress (Click to Read Post)

- Property sellers get it too — many are acutely aware of the housing affordability crisis and the barriers the next generations face. They may have children or grandchildren who are finding it increasingly difficult to enter the property market. By participating in solutions like AffordAssist, sellers can ‘pay it forward,’ creating opportunities for the next generation while also indirectly supporting their own family’s future. It’s a way to contribute to social good and foster community resilience, all while responsibly managing their own property interests.

This is social impact through design, not donation.

A Community-Centric Approach to a Systemic Problem

Housing affordability won’t be solved by a single policy, product, or subsidy.

But it can be improved by rethinking structures that can better serve the community.

AffordAssist Interest-Free Deferred Deposit Solution — a smarter alternative to cash deposits — is critically positioned where commercial discipline, social responsibility, and practical outcomes meet.

That’s not charity.

That’s sustainable social enterprise in action.

Regards

AA

B2B – AffordAssist facilitates and oversees the governance process. Are you a mortgage broker, lender, developer, real estate agent, affordable housing advocate, or housing minister? We welcome your collaboration. Join us in our mission to expand access to home ownership. Together, we can make a lasting impact.

#HousingAffordability #SocialEnterprise #FinancialInclusion #GenerationalWealth #SustainableSolutions