Easing the Housing Affordability Crisis — “Without Cash”

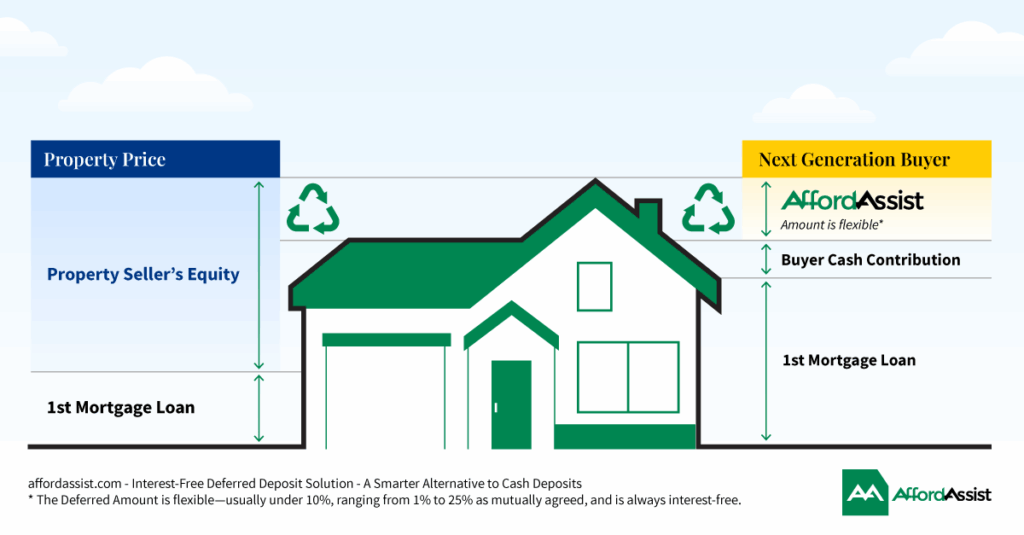

Dear All, We can ease the housing affordability crisis without cash, using solutions that reflect how the economy continues to change and how people actually live, earn, and pay — not just how housing has traditionally been funded: through the Bank of Mum and Dad, equity, guarantors, second mortgages, personal loans, high-risk structures, or ongoing […]

Easing the Housing Affordability Crisis — “Without Cash” Read More »